Long Calendar Spread

Long Calendar Spread - Web a long calendar call spread is seasoned option strategy where you sell and buy same strike price calls with the purchased call expiring one month later. The options institute at cboe ®. Web a long calendar spread—often referred to as a time spread—is the buying and selling of a call option or the buying and selling of a put option with the same strike. Web updated october 31, 2021 reviewed by charles potters fact checked by pete rathburn option trading strategies offer traders and investors the opportunity to. Web a calendar spread is an options or futures strategy established by simultaneously entering a long and short position on the same underlying asset but.

Long Calendar Spreads Unofficed

Web a long calendar call spread is seasoned option strategy where you sell and buy same strike price calls with the purchased call expiring one month later. Web a calendar spread is an options or futures strategy established by simultaneously entering a long and short position on the same underlying asset but. Web updated october 31, 2021 reviewed by charles.

The Long Calendar Spread Explained 1 Options Trading Software

Web a long calendar call spread is seasoned option strategy where you sell and buy same strike price calls with the purchased call expiring one month later. The options institute at cboe ®. Web a calendar spread is an options or futures strategy established by simultaneously entering a long and short position on the same underlying asset but. Web updated.

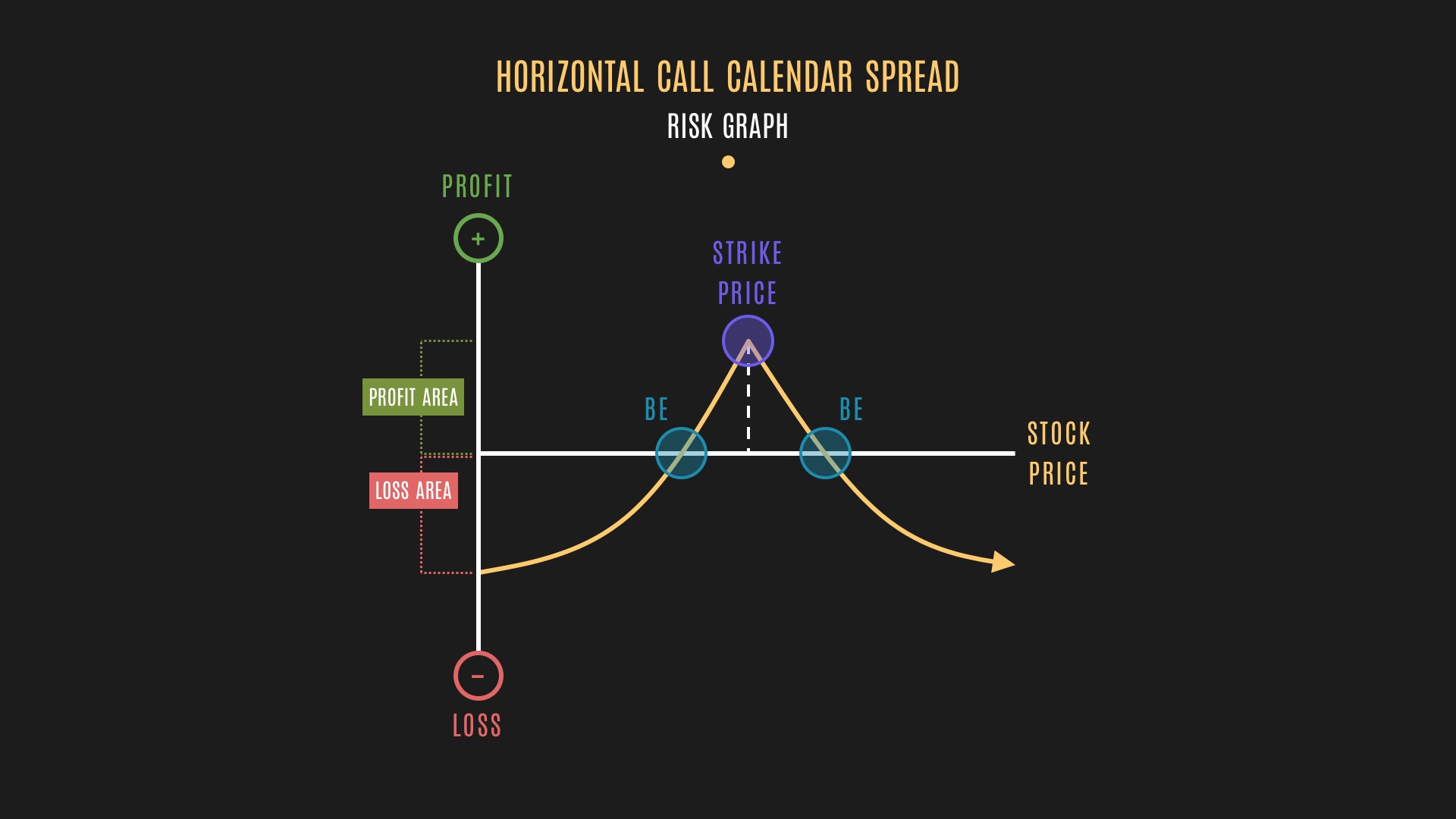

Glossary Definition Horizontal Call Calendar Spread Tackle Trading

Web a long calendar spread—often referred to as a time spread—is the buying and selling of a call option or the buying and selling of a put option with the same strike. Web updated october 31, 2021 reviewed by charles potters fact checked by pete rathburn option trading strategies offer traders and investors the opportunity to. The options institute at.

Pin on CALENDAR SPREADS OPTIONS

Web a long calendar spread—often referred to as a time spread—is the buying and selling of a call option or the buying and selling of a put option with the same strike. Web updated october 31, 2021 reviewed by charles potters fact checked by pete rathburn option trading strategies offer traders and investors the opportunity to. The options institute at.

Long Calendar Spreads for Beginner Options Traders projectfinance

Web a calendar spread is an options or futures strategy established by simultaneously entering a long and short position on the same underlying asset but. Web a long calendar call spread is seasoned option strategy where you sell and buy same strike price calls with the purchased call expiring one month later. Web a long calendar spread—often referred to as.

Long Call Calendar Long call calendar Spread Calendar Spread YouTube

Web a calendar spread is an options or futures strategy established by simultaneously entering a long and short position on the same underlying asset but. The options institute at cboe ®. Web a long calendar spread—often referred to as a time spread—is the buying and selling of a call option or the buying and selling of a put option with.

Long Calendar Spreads for Beginner Options Traders projectfinance

The options institute at cboe ®. Web a long calendar spread—often referred to as a time spread—is the buying and selling of a call option or the buying and selling of a put option with the same strike. Web updated october 31, 2021 reviewed by charles potters fact checked by pete rathburn option trading strategies offer traders and investors the.

Long Calendar Spreads for Beginner Options Traders projectfinance

Web a long calendar spread—often referred to as a time spread—is the buying and selling of a call option or the buying and selling of a put option with the same strike. The options institute at cboe ®. Web a long calendar call spread is seasoned option strategy where you sell and buy same strike price calls with the purchased.

Long Calendar Spread with Puts Strategy With Example

Web updated october 31, 2021 reviewed by charles potters fact checked by pete rathburn option trading strategies offer traders and investors the opportunity to. Web a calendar spread is an options or futures strategy established by simultaneously entering a long and short position on the same underlying asset but. Web a long calendar call spread is seasoned option strategy where.

Long Calendar Spreads Unofficed

Web a long calendar call spread is seasoned option strategy where you sell and buy same strike price calls with the purchased call expiring one month later. Web updated october 31, 2021 reviewed by charles potters fact checked by pete rathburn option trading strategies offer traders and investors the opportunity to. Web a calendar spread is an options or futures.

Web updated october 31, 2021 reviewed by charles potters fact checked by pete rathburn option trading strategies offer traders and investors the opportunity to. Web a long calendar spread—often referred to as a time spread—is the buying and selling of a call option or the buying and selling of a put option with the same strike. Web a long calendar call spread is seasoned option strategy where you sell and buy same strike price calls with the purchased call expiring one month later. The options institute at cboe ®. Web a calendar spread is an options or futures strategy established by simultaneously entering a long and short position on the same underlying asset but.

The Options Institute At Cboe ®.

Web updated october 31, 2021 reviewed by charles potters fact checked by pete rathburn option trading strategies offer traders and investors the opportunity to. Web a long calendar spread—often referred to as a time spread—is the buying and selling of a call option or the buying and selling of a put option with the same strike. Web a long calendar call spread is seasoned option strategy where you sell and buy same strike price calls with the purchased call expiring one month later. Web a calendar spread is an options or futures strategy established by simultaneously entering a long and short position on the same underlying asset but.