Long Put Calendar Spread

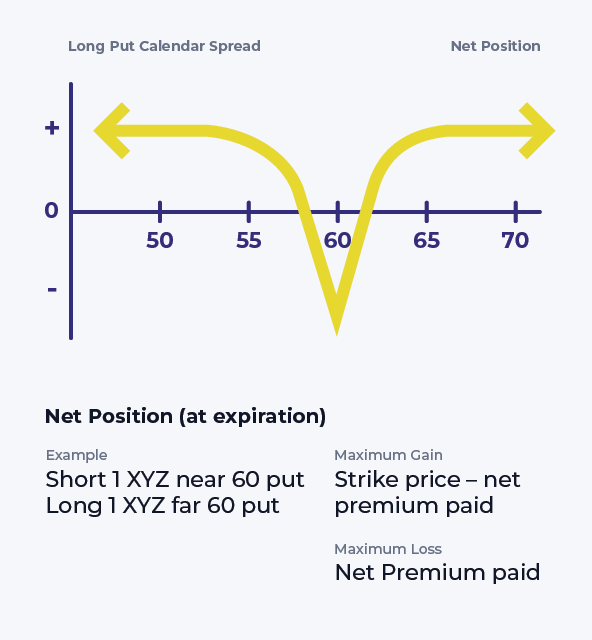

Long Put Calendar Spread - Web the short calendar put spread is a strategy that can be used when you have forecasted that a security will move sharply in price,. Web a long calendar spread—often referred to as a time spread—is the buying and selling of a call option or the buying and selling of a put option with the same strike price but having. Web long put calendar spreads profit from a slightly lower move down in the underlying stock in a given range. Web a calendar spread is an options or futures strategy established by simultaneously entering a long and short. Web a long calendar spread consists of two options of the same type and strike price, but with different expirations. Web the objective for a long call calendar spread is for the underlying stock to be at or near, nearest strike price at expiration and take. Web a calendar spread is an option trade that involves buying and selling an option on the same instrument with the. Web a long put calendar spread involves buying and selling put options for the same underlying security at the same.

Put Calendar Spread

Web a long calendar spread—often referred to as a time spread—is the buying and selling of a call option or the buying and selling of a put option with the same strike price but having. Web the objective for a long call calendar spread is for the underlying stock to be at or near, nearest strike price at expiration and.

Bearish Put Calendar Spread Option Strategy Guide

Web long put calendar spreads profit from a slightly lower move down in the underlying stock in a given range. Web a long calendar spread—often referred to as a time spread—is the buying and selling of a call option or the buying and selling of a put option with the same strike price but having. Web a calendar spread is.

Bearish Put Calendar Spread Option Strategy Guide

Web a calendar spread is an option trade that involves buying and selling an option on the same instrument with the. Web a long calendar spread—often referred to as a time spread—is the buying and selling of a call option or the buying and selling of a put option with the same strike price but having. Web long put calendar.

Bearish Put Calendar Spread Option Strategy Guide

Web a calendar spread is an option trade that involves buying and selling an option on the same instrument with the. Web a long put calendar spread involves buying and selling put options for the same underlying security at the same. Web the short calendar put spread is a strategy that can be used when you have forecasted that a.

Bearish Put Calendar Spread Option Strategy Guide

Web a long calendar spread—often referred to as a time spread—is the buying and selling of a call option or the buying and selling of a put option with the same strike price but having. Web a long calendar spread consists of two options of the same type and strike price, but with different expirations. Web the short calendar put.

Calendar Put Spread Options Edge

Web a long put calendar spread involves buying and selling put options for the same underlying security at the same. Web a long calendar spread—often referred to as a time spread—is the buying and selling of a call option or the buying and selling of a put option with the same strike price but having. Web the short calendar put.

Long Put Calendar Spread (Put Horizontal) Options Strategy

Web the short calendar put spread is a strategy that can be used when you have forecasted that a security will move sharply in price,. Web a long calendar spread consists of two options of the same type and strike price, but with different expirations. Web long put calendar spreads profit from a slightly lower move down in the underlying.

Long Calendar Spread with Puts Strategy With Example

Web a long calendar spread consists of two options of the same type and strike price, but with different expirations. Web long put calendar spreads profit from a slightly lower move down in the underlying stock in a given range. Web the short calendar put spread is a strategy that can be used when you have forecasted that a security.

Put Calendar Spread Guide [Setup, Entry, Adjustments, Exit]

Web a calendar spread is an options or futures strategy established by simultaneously entering a long and short. Web a calendar spread is an option trade that involves buying and selling an option on the same instrument with the. Web a long calendar spread consists of two options of the same type and strike price, but with different expirations. Web.

Long Calendar Spreads Unofficed

Web the short calendar put spread is a strategy that can be used when you have forecasted that a security will move sharply in price,. Web a calendar spread is an option trade that involves buying and selling an option on the same instrument with the. Web long put calendar spreads profit from a slightly lower move down in the.

Web a calendar spread is an option trade that involves buying and selling an option on the same instrument with the. Web a long put calendar spread involves buying and selling put options for the same underlying security at the same. Web a long calendar spread—often referred to as a time spread—is the buying and selling of a call option or the buying and selling of a put option with the same strike price but having. Web a long calendar spread consists of two options of the same type and strike price, but with different expirations. Web the short calendar put spread is a strategy that can be used when you have forecasted that a security will move sharply in price,. Web long put calendar spreads profit from a slightly lower move down in the underlying stock in a given range. Web the objective for a long call calendar spread is for the underlying stock to be at or near, nearest strike price at expiration and take. Web a calendar spread is an options or futures strategy established by simultaneously entering a long and short.

Web A Calendar Spread Is An Options Or Futures Strategy Established By Simultaneously Entering A Long And Short.

Web long put calendar spreads profit from a slightly lower move down in the underlying stock in a given range. Web a calendar spread is an option trade that involves buying and selling an option on the same instrument with the. Web the short calendar put spread is a strategy that can be used when you have forecasted that a security will move sharply in price,. Web the objective for a long call calendar spread is for the underlying stock to be at or near, nearest strike price at expiration and take.

Web A Long Put Calendar Spread Involves Buying And Selling Put Options For The Same Underlying Security At The Same.

Web a long calendar spread—often referred to as a time spread—is the buying and selling of a call option or the buying and selling of a put option with the same strike price but having. Web a long calendar spread consists of two options of the same type and strike price, but with different expirations.

![Put Calendar Spread Guide [Setup, Entry, Adjustments, Exit]](https://i2.wp.com/assets-global.website-files.com/5fba23eb8789c3c7fcfb5f31/6019b83133ac2d32ef084fa5_TsbQgZxQ0e-zKJ9h6Fa7azNlnvn0zH-UBlX3l7hriHll2es1fvyFY5N-nOyM1153MJ4wXLNIhH4zanFkJQB0mpqs81lwEBIvqa7IZQRPWXZY1i3J7vV3BpTIL3v5nCyqn-CEbq2U.png)